Thousands Of U.S. Farmers Could Unknowingly Face Federal Fines Or Jail Time

Time is running out for thousands of farmers who may face steep fines and possible jail time for failing to file their businesses with the federal government.

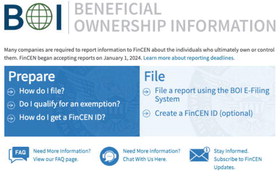

Jan. 1, 2025, is the deadline to file Beneficial Ownership Information with the U.S. Department of Treasury’s Financial Crimes Enforcement Network.

New analysis in a Market Intel by American Farm Bureau Federation economists shows more than 230,000 farms are required to file, but government data indicates less than 11 percent of all eligible businesses nationwide have done so.

The Corporate Transparency Act of 2021 required businesses to register any “beneficial owner” of a company to combat money laundering. Many farms are structured as either a C-corporation, S-corporation or limited liability company, which are now required to be registered if they employ fewer than 20 employees or receive under $5 million in cash receipts — which covers the vast majority of farms.

“The use of LLCs is an important tool for many farms to keep personal and business assets separated, but small businesses often lack the staff to track and stay in compliance with changing rules and regulations,” said AFBF president Zippy Duvall. “It’s clear that many farmers aren’t aware of the new filing requirement. Unclear guidance and lack of public outreach are now putting thousands of America’s farmers at risk of violating federal law.”

Businesses that fail to file, or do not update records when needed, could face criminal fines up to $10,000 and additional civil penalties of up to $591 per day. Failure to file could also lead to felony charges and up to two years in prison.

“The greater farm economy will also be impacted by CTA requirements,” AFBF economists write. “Many feed and supply stores, crop marketers like grain elevators and the greater rural business community are also likely required to file their BOI and subject to penalties if they do not comply. The regulatory burdens and potential enforcement crackdowns could have ripple effects throughout the entire food, fiber and fuel supply chains.”

According to Gina Stevens, MFBF Taxation Committee chair, if your entity is set up with a lawyer, contact that lawyer to see if the BOI has already been filed. If you must file a BOI, it needs to be completed either by yourself or by a legal person such as a tax attorney. Your accountant cannot do this for you.

Stevens, a Hardin accountant, added that if you formed a reporting entity in 2024 you only have 60 days to file this form.

“We’ve been telling people that if they file with the Montana Secretary of State, chances are they need to file a BOI. If you are unsure whether you are required to file your business's BOI with FinCEN, contact your accountant or tax attorney immediately,” noted Stevens. “It is wiser to inquire and find out you don’t need to file a BOI than face high fines and even jail time if you needed to file but didn’t.”

Read the Market Intel Report at https://www.fb.org/marketintel/ corporate-transparencyact- deadline-looming. Visit https://fincen.gov/boi to file your report.